Mitihoon – KASIKORN Business-Technology Group (KBTG) has solidified its position as a leading fintech innovator with the introduction of a subscription model for MeowJot, its popular expense-tracking application. The upgraded app now supports e-slips from 16 leading Thai mobile banking applications, empowering users to gain insights into their personal spending behavior and track expenses more conveniently than ever. With the launch of two new packages at special 2024 annual rates, MeowJot aims to foster personal financial discipline and advance Thailand towards a cashless society.

Mitihoon – KASIKORN Business-Technology Group (KBTG) has solidified its position as a leading fintech innovator with the introduction of a subscription model for MeowJot, its popular expense-tracking application. The upgraded app now supports e-slips from 16 leading Thai mobile banking applications, empowering users to gain insights into their personal spending behavior and track expenses more conveniently than ever. With the launch of two new packages at special 2024 annual rates, MeowJot aims to foster personal financial discipline and advance Thailand towards a cashless society.Mr. Chetaphan Siridanupath, Managing Director, KBTG, said, “KBTG has pioneered financial innovations to foster personal financial discipline and promote digital banking adoption in Thailand, as part of our efforts to drive Thailand towards a cashless society, in line with the Bank of Thailand’s policy. To this end, we have developed MeowJot, an automated expense-tracking application that reads transaction e-slips from mobile banking apps. The app processes this information and generates daily and monthly spending summaries, allowing users to easily and efficiently monitor their expenses and track their spending habits without the need for manual record-keeping.”

The basic features of MeowJot that are free of charge include: 1. Automatic recording of expenses and amounts, based on the information from e-slips on mobile phones; 2. A summary of expenses that is more comprehensive than with a single banking application as it consolidates expenses from all banking applications into one place and supports e-slips of 16 mobile banking apps; and 3. Personal journal of additional expenses through other channels, such as cash or credit card payments. Since its unofficial launch in December 2023, response towards MeowJot has exceeded expectations, with 10,000 downloads during the first 10 hours and over 100,000 users within just six months. To better meet users’ needs for expense recording, as per their requests, MeowJot recently introduced a subscription system with two packages as follows:

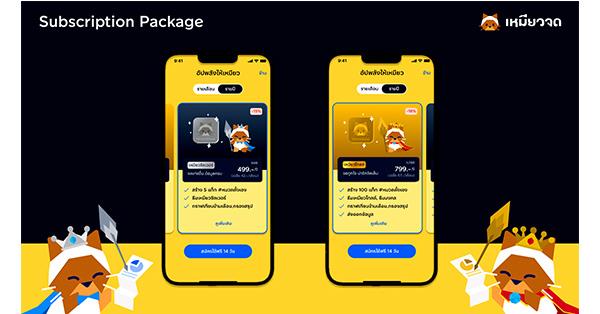

MeowJot Silver (79 Baht/month) is suitable for those who prefer to view their expenses in the application. It includes features that make expense recording more convenient, such as: 1. Automatic categorization for 200,000 popular stores. If the selected category does not match the user’s need, the user can easily edit it. More stores will be added in this package in the future; 2. Viewing of past transactions without any monthly limit; and 3. Up to five tags (#) can be used to track expenses, 3. Meow Silver theme; and, 4. Trend chart report and Report filter (available soon).

MeowJot Gold (149 Baht/month) is ideal for those who love recording expenses and prefer more detailed customization. This package offers the most comprehensive set of features in additional to the MeowJot Silver package, including: 1. Up to 100 tags (#) to track specific expenses; 2. Five new special themes, including the Meow Gold theme and four auspicious Meow themes to enhance luck; and 3. Data export in CSV file format (available soon).

In addition, KBTG is offering a special promotion to celebrate the launch of the MeowJot subscription model. Simply choose an annual payment for a package and get a special discount. The MeowJot Silver package, normally priced at 79 Baht/month or 948 Baht/year, is now available for only 499 Baht/year. The MeowJot Gold package, normally priced at 149 Baht/month or 1,788 Baht/year, is now only 799 Baht/year. This promotion is limited to new subscribers in 2024. Those interested in using the free version or a subscription package can download the MeowJot app at https://meowjot.onelink.me/A393/install.

Mr. Chetaphan noted in closing that users can be assured of their privacy, as the MeowJot app is allowed to access only images in the mobile banking album. Interested persons can download and use the app, regardless of whether they have a KBank account. MeowJot supports up to 16 major Thai banking apps, catering to users with multiple bank accounts, allowing them to consolidate their spending records in one place. KBTG aims to reach 200,000 MeowJot users and 6,000 subscribers by the end of 2024.

The 16 major banking apps that MeowJot supports include K PLUS, MAKE by KBank, Krungthai NEXT, Bangkok Bank, CIMB Thai Digital Banking, UOB TMRW Thailand, SCB Easy, ttb touch, Mymo by GSB, KMA-Krungsri, Kept, Dime!, KKP MOBILE, GHB ALL GEN, TISCO My Wealth, and LHB You.

Web : https://www.mitihoon.com/

Facebook : https://www.facebook.com/mitihoon

Youtube : https://www.youtube.com/@mitihoonofficial7770

Tiktok : www.tiktok.com/@mitihoon